The Finance Ministry of India introduced a new tax regime for taxpayers in the Union Budget 2020, earlier this year. New tax slabs with lowered tax rates have been introduced but at the cost of letting go of certain exemptions. We’re thrilled to let you know that uknowva is now dual-tax regime compliant.

Here's how uKnowva's dual tax regime complaint system will help you can make an informed decision.

Which one is more beneficial in the new tax regime?

We know there are currently two distinct tax systems in operation. Choosing the one that helps you save the most tax would be the ideal option. On reviewing the new tax slabs it can be found that the reduced tax rates seem beneficial but at the same time, it demands you to let go of the multiple deductions and exemptions.

Some of these deductions that you would have to let go, on a selection of the new tax regime, are the ones that fall under Section 80C, 80D, Section 24, Section 80CCD, and Section 80E. Exemptions under Section 10 ( like HRA and LTA) would also have to be relinquished.

You need to make an informed decision keeping your tax liabilities and savings in mind and choose the new tax regime that makes the most sense.

How to determine your preferred tax regime?

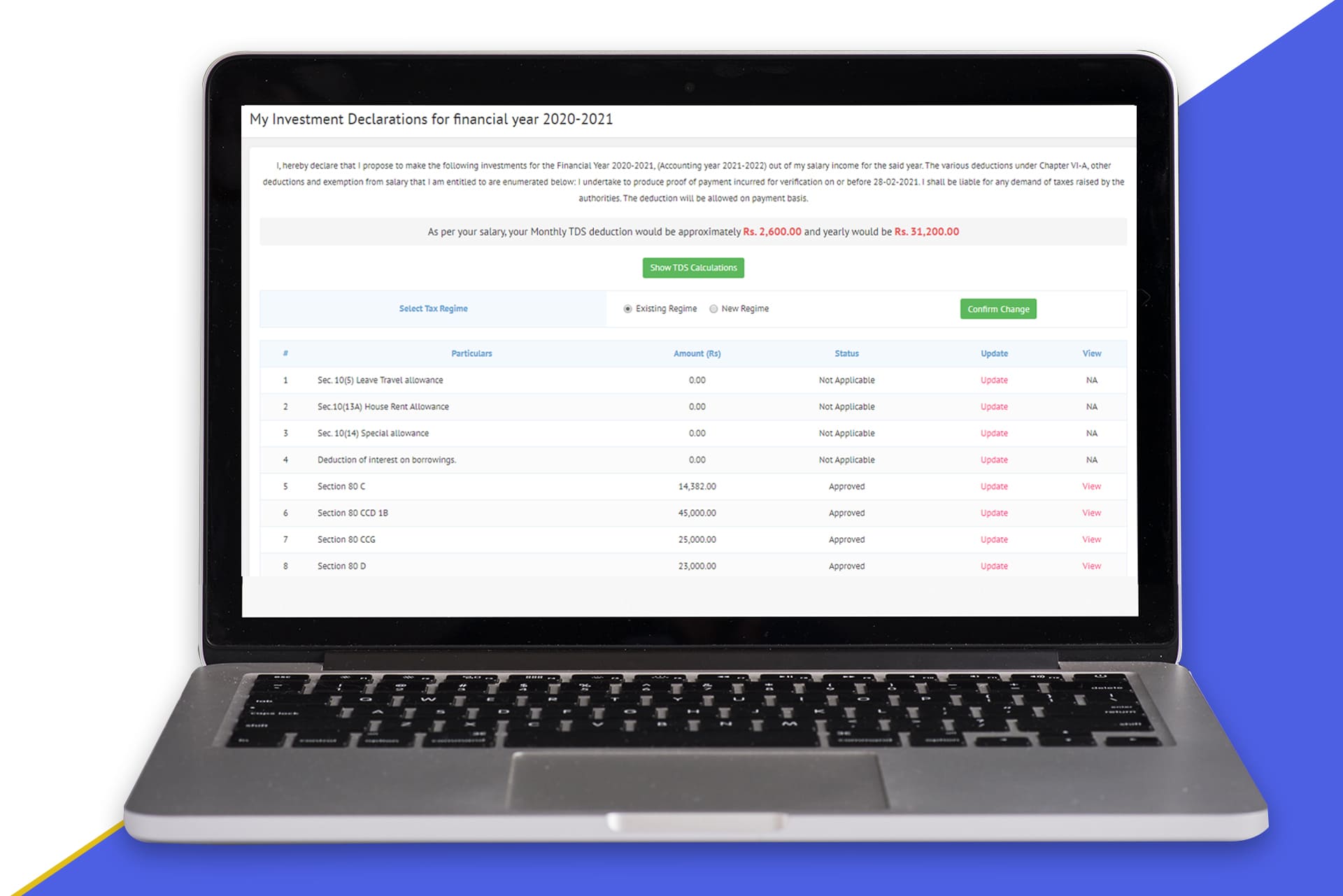

As uknowva is now dual-tax regime compliant, you can now pick your preferred regime during the time of your investment declaration for the financial year.

You can also see your projected taxes for the year based on your income and regime, to make an informed decision keeping your tax liabilities and savings in mind.

Following these simple steps in uknowva will help you arrive at your decision:

- Declare your taxes the same way as before (under Investment Declarations tab)

- Review the break up of taxes under both the regimes

- Choose the regime that makes the most sense

- You can switch between the two regimes by a simple selection.

To Summarize:

As an employer, it's crucial to communicate and educate your employees about the new tax system, helping them choose the tax regime that minimises the most tax. Choosing a Payroll system that is dual tax regime complaint has become the need of the hour.

Having uKnowva as your payroll partner will help your employees easily make an informed decision. Apart from being dual tax regime compliant, uKnowva has always been quick in implementing government updates that make us an all compliant and most fitting payroll software for your organisation.

Knowing this information we hope it's easy for you to choose between the old and the new tax regime with uknowva!

Go ahead and upgrade to uKnowva's Dual Tax Regime Compliant Payroll this Financial Year, click here: https://uknowva.com/extensions/investment-declaration/106