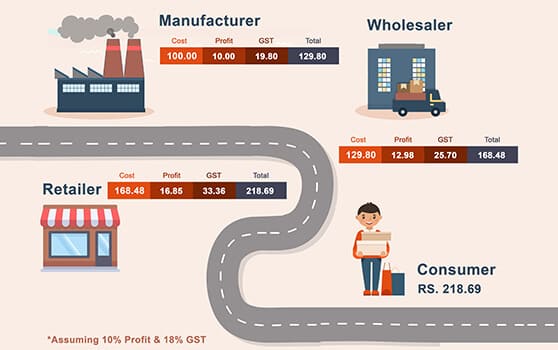

Goods and Services Tax (GST)

Goods and Services Tax (GST) is an all-inclusive goods and services tax which is charged on supply of all goods and services across India. The aim of GST is to remove all the existing indirect taxes and create a single market by reducing the barriers between states.

How It Works

What is GST Invoicing Process?

Bill of Supply

Bill of supply is to be issued by a registered supplier who is producing nontaxable goods and services. In this case, the supplier is not allowed to charge any tax under GST system.

Instances where a registered supplier needs to issue bill of supply.

- Supply of exempted goods or services.

- Supplier is paying tax under composition scheme.

Tax Invoice

Every business owners who produce goods and services which are taxable by the government has to be registered under the GST system. All individuals who are registered under GST have to issue Tax Invoice every time a sale of goods or supply of service is made by a registered person.

GST Invoicing Process

In the case of supply of services, two copies of invoices have to be prepared for the following parties:

- The original copy being marked as ORIGINAL FOR RECIPIENT.

- The duplicate copy being marked as DUPLICATE FOR SUPPLIER.

In the case of supply of goods, three copies of invoices have to be prepared for the following parties:

- Original copy marked as ORIGINAL FOR RECIPIENT.

- Duplicate copy marked as DUPLICATE FOR TRANSPORTERS.

- Triplicate copy marked as TRIPLICATE FOR SUPPLIER.

Time Limit to Issue Invoice

- The time limit specified for issuing an invoice for goods is anytime before its delivery.

- The time limit specified for issuing an invoice for services is within 30 days from the date of supply of services.

HSN and SAC Code

Harmonized System of Nomenclature (HSN) is an international multipurpose product nomenclature developed by the World Customs Organization (WCO).

Services Accounting Code (SAC) is a classified system for service accounting codes issued by the government for service tax.

HSN code is applied for the sale of goods and SAC code is applied for each type of services provided.